eCommerce Answers

Find expert answers to all your eCommerce questions, from learning how to start and scale an online store to apps, tools, marketing strategies, inventory management, and more.

Recent Answers

How to Link Products on Shopify the Right Way

Shopify offers entrepreneurs an array of tools to manage their online stores seamlessly. Amidst these functionalities, product linking often remains underappreciated. Understanding how to effectively

Asked 2 years ago

Dummy Proof: How to Export Sample Data From Shopify

Data powers e-commerce success, and mastering Shopify data export is crucial for merchants. Sample data is your secret weapon when establishing your online store. Sample data is a safe testing ground

Asked 2 years ago

How to Acquire Phone Numbers for SMS Marketing

Are you seeking a way to boost your sales, increase customer loyalty, and reach new audiences? SMS marketing might be the answer. SMS marketing offers numerous advantages for businesses in various sec

Asked 3 years ago

How to Do Affiliate Marketing With YouTube Shorts

Are you looking to make money online by promoting other people's products or services? Try affiliate marketing. Affiliate marketing is when you earn a commission for every sale or action you generate

Asked 3 years ago

How to Change Image Resolution on Shopify: Create High-Quality Product Images

Image resolution refers to the number of pixels in an image and profoundly affects how sharp and clear your images look on different devices and screen sizes. Benefits of high-resolution product ima

Asked 3 years ago

Related Articles

How to Create an Abandoned Cart Recovery Email Campaign

Brody Hall

February 10, 2023

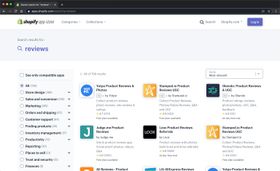

The Benefits of Using a Product Review App on Your Shopify Store

Brody Hall

March 29, 2023

How to Import Products From AliExpress to Shopify

Brody Hall

May 2, 2023

How to Change Your Shopify Store Name and Choose a Better Name

Brody Hall

August 10, 2021

Top 3 Disadvantages of Manual Bookkeeping in Ecommerce

Brody Hall

February 10, 2023

Recent Posts

Join KeepShoppers’ Newsletter

Many entrepreneurs have signed up to receive tips, tricks, and news on how to run a successful eCommerce business.

By entering your email, you agree to receive marketing emails. Information is collected in accordance with our Privacy Policy. You can unsubscribe any time.