12 Best Buy Now Pay Later Apps for Your Shopify Store in 2026

Looking to offer your customers more flexible payment options? Try one of the top Buy Now Pay Later apps to take your Shopify store to the next level in 2023.

Updated November 16, 2023

Our team independently researches and recommends the best products and services. We publish reviews that are unbiased and not influenced by payments we may receive from advertising partners.

Buy Now Pay Later (BNPL) apps increase payment flexibility for your e-commerce store. Clients can make an order now and spread the payment over time while the seller gets paid instantly. In 2022, an estimated 360 million shoppers used BNPL— a number that is expected to grow to over 900 million by 2027.

Having a BNPL option for your store has numerous benefits: it can lead to more time spent on your store, reduce cart abandonment, and increase average cart value. Plus, BNPL providers facilitate the payments and take on the role of a lender while you, the seller, remain risk-free.

There is a wide selection of BNPL services available for e-commerce stores. We've selected the top 12 to get you started.

Our Top Picks for the Best Buy Now Pay Later Solutions

- Shop Pay Installments – Best for US Shopify Stores

- SpurIT Installment Invoices – Best for Customizable Payments

- Perpay – Best Credit-Building Payment Solution

- Klarna – Best for Flexible Payments

- Razorpay – Best for India-Based Stores

- Splitit – Best for Credit Card Payments

- Afterpay – Best for a Younger Customer Base

- PayPal – Best for Small Purchases

- Sezzle – Best for Smaller E-Commerce Stores

- Affirm – Best for Big Ticket Items

- Laybuy – Best for Risk and Fraud Management

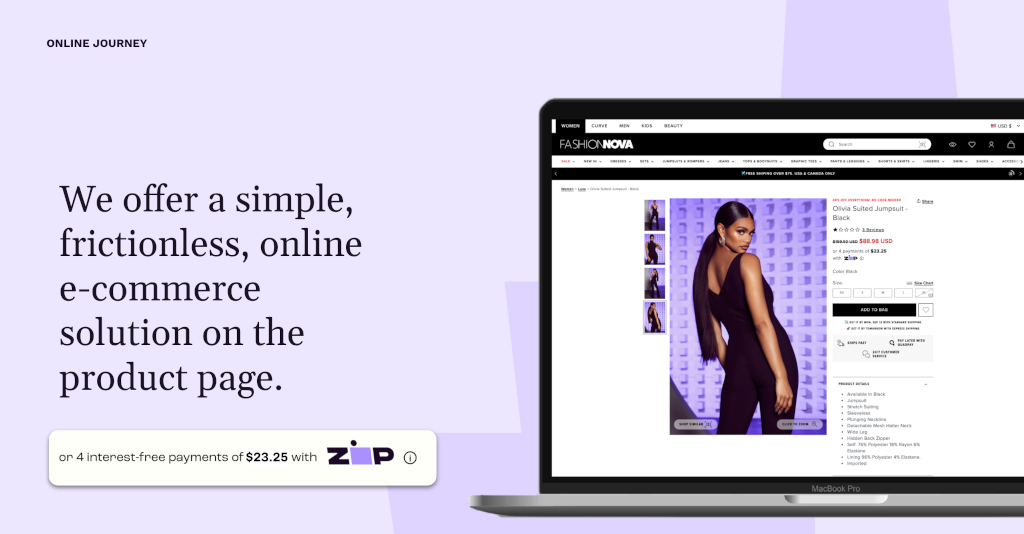

- Zip – Best for Ease of Use

1. Best for US Shopify Stores

KeepShoppers Score: 9.9

Key Features

- All-in-one Shopify integration

- Full upfront payment, regardless of the plan

- Supports order tracking

Shop Pay Installments is Shopify's native BNPL service. If you have it installed, your customers will be able to pay in four interest-free payments or monthly installments for up to 12 months, while you'll get paid instantly. It's a fully integrated solution that makes the process hassle-free for Shopify users.

Why We Liked It

You can activate Shop Pay Installments directly from your Shopify admin. Due to its native Shopify integration, this is an incredibly quick solution that offers excellent performance and loading times. Shopify's BNPL is the largest installment payment provider for US-based merchants, making it the best option for your US Shopify store.

Pros

- Flexible payment plans

- Simple to install

- Quick checkout

- Fraud protection

- No hidden fees

Cons

- Only available to US-based stores

- Installments cost more than standard purchases

» Here's how to add Shop Pay Installments to your Shopify store

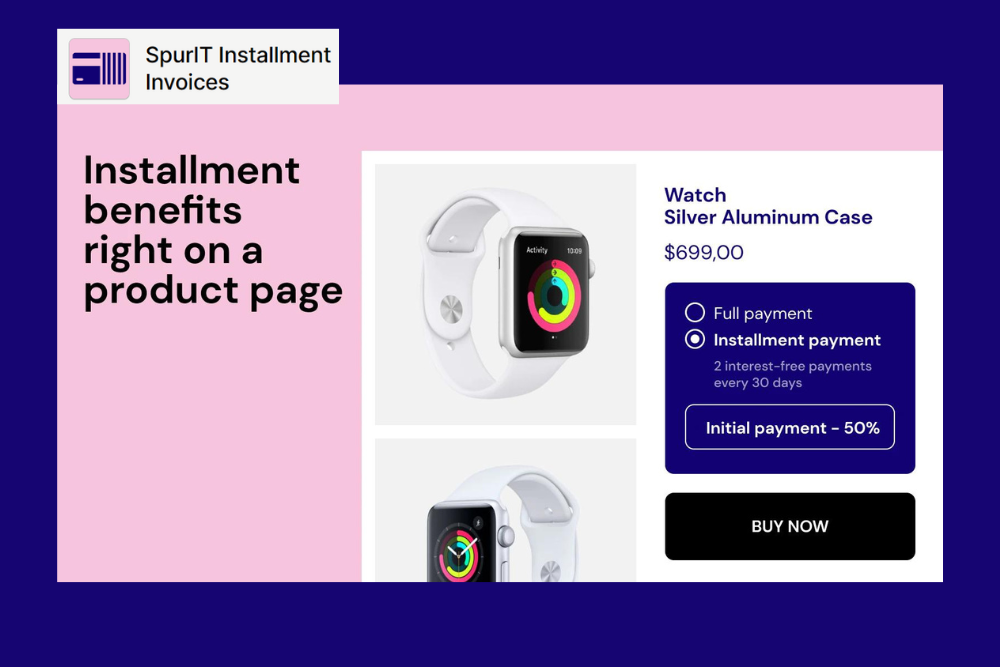

2. Best for Customizable Payments

KeepShoppers Score: 9.8

Key Features

- Flexible payment plans

- Adjustable initial payment

- Automated recurring invoices

SpurIT Installment Invoices lets Shopify stores offer flexible payment options so their customers can pay for purchases over time with customizable plans. It automates recurring invoices and supports adjustable initial payments, enhancing customer purchasing power and average order values.

Why We Liked It

We highly recommend SpurIT Installment Invoices for its versatility and user-friendly interface. Its easy customization options and compatibility with Shopify themes make it a must-have tool for any e-commerce business seeking to enhance its payment options and increase average order values. Plus, by offering customizable payment plans, you can easily accommodate a wide range of customer preferences. This helps you to boost sales and improve overall customer satisfaction.

Pros

- Versatile payment plans

- Easy-to-use interface

- Automated invoices to streamline payment management

- High compatibility with Shopify themes

Cons

- Priority support with higher plan only

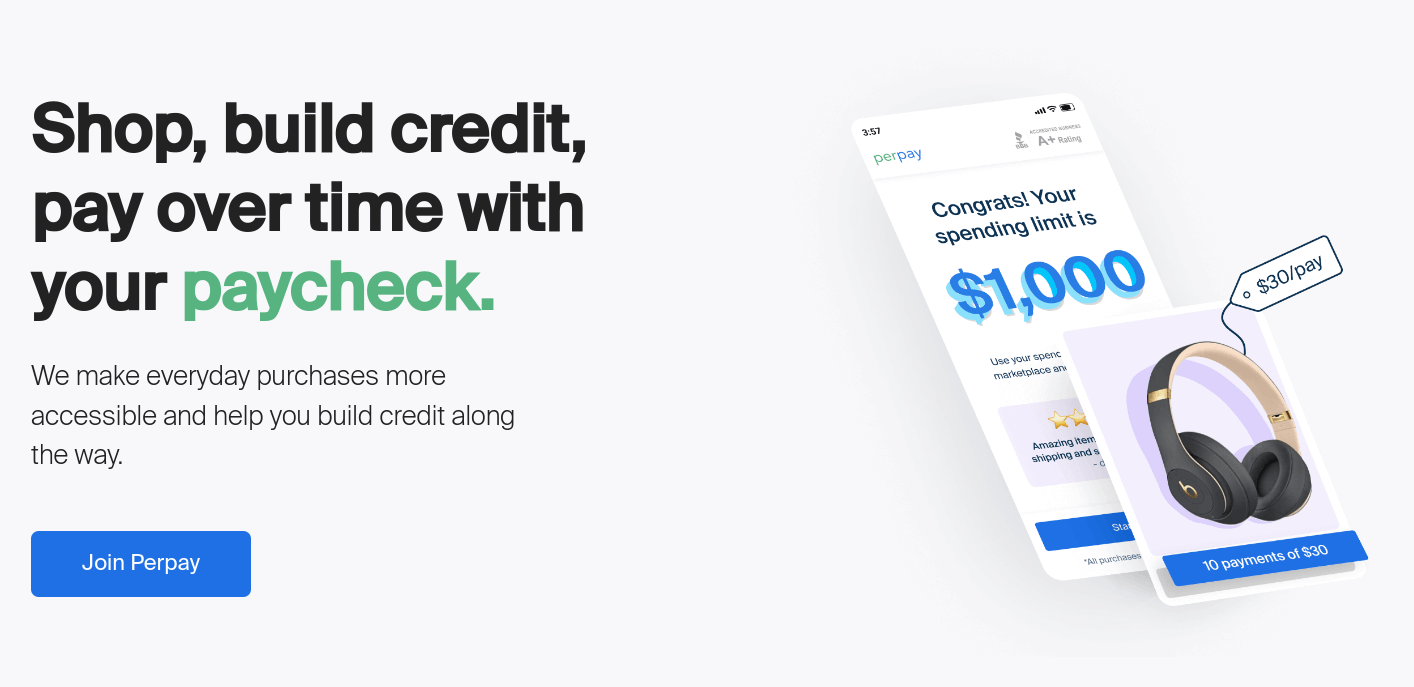

3. Best Credit-Building Payment Solution

KeepShoppers Score: 9.6

Key Features

- Flexible payment options

- Credit building

- Personalized spending limit

Perpay is a financial technology platform that allows users to shop for products and pay for them over time with flexible payment options, helping them build credit along the way. It provides a personalized spending limit and reports payment history to credit bureaus, potentially improving users' credit scores.

Why We Liked It

The platform's 'buy now, pay later' model not only attracts a broader customer base but also reduces the likelihood of abandoned shopping carts, ultimately boosting sales. Moreover, Perpay's commitment to transparent pricing, zero membership or late fees, and an easy-to-navigate mobile app creates a seamless shopping experience for both you and your customers.

Pros

- Flexible payment plans

- No interest or fees

- Credit building

- Easy approval process

- User-friendly app

Cons

- Not available everywhere

- Shopping options limited to Perpay's marketplace

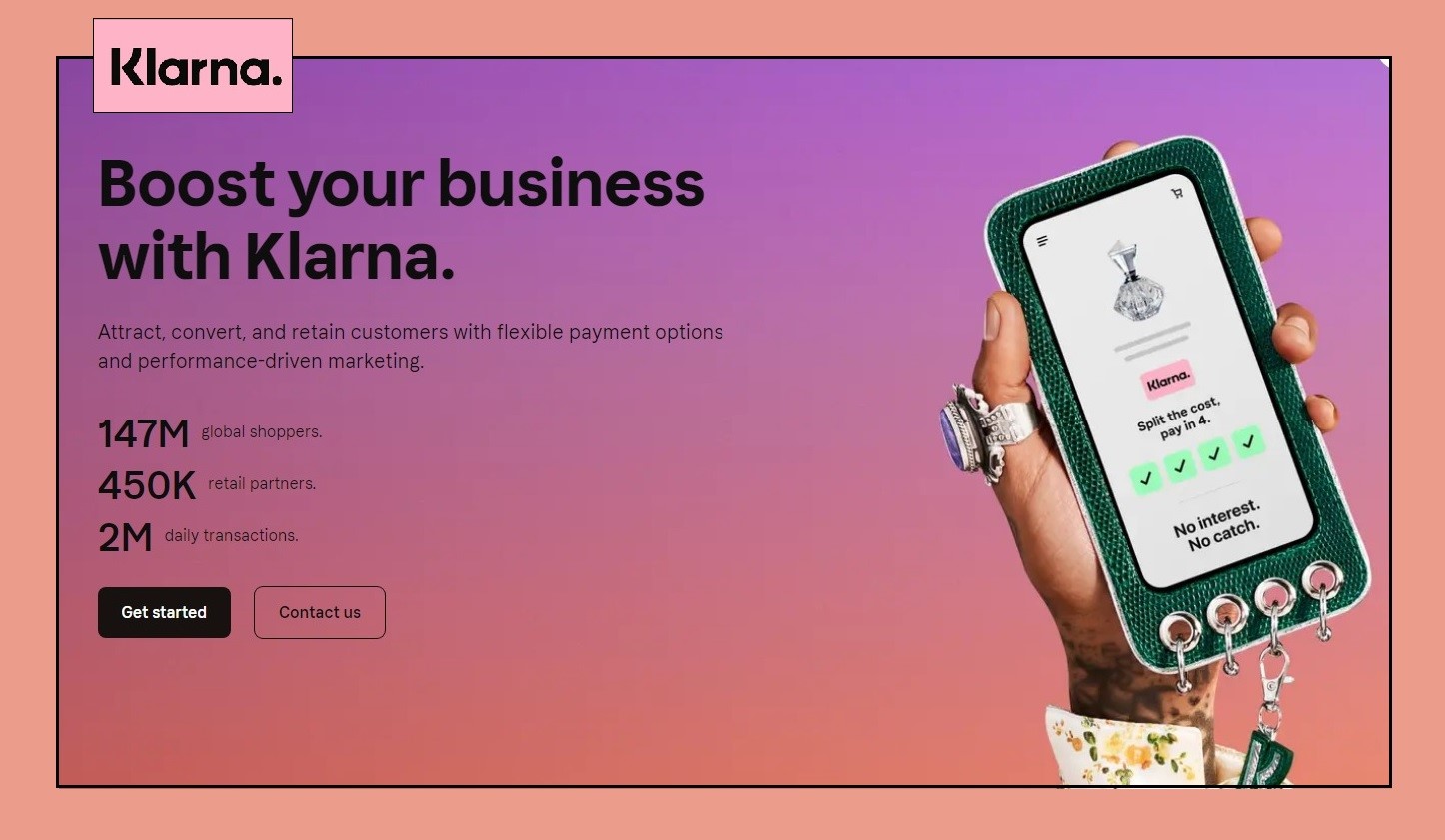

4. Best for Flexible Payments

KeepShoppers Score: 9.6

Key Features

- Virtual card

- Loyalty program

- Payment plans of up to 24 months

Klarna is a well-known Shopify BNPL solution that offers a lot to both merchants and customers. It's used by top international brands, including H&M, Sephora, Adidas, and The North Face. You can offer interest-free installments and a payment term of up to 24 months.

Klarna also has a Shopify App, Klarna On-site Messaging, to let customers know they can use Klarna and what their payments will look like. This is an extra level of service that can make a big difference in terms of building trust and loyalty with your customers.

Why We Liked It

One feature that really sets Klarna apart is its excellent flexibility when it comes to payment options. Customers can use it online or in-store in multiple ways: in 4 interest-free payments, in 30 days, in up to 24 months, or instantly. And, of course, you always get paid in full regardless of which option the customer chooses.

Pros

- Internationally accepted

- Low APR for long-term loans

- Good security

Cons

- High processing fees

- Each purchase must be approved

» Want to get started? Learn how to set up Klarna for your Shopify store in no time

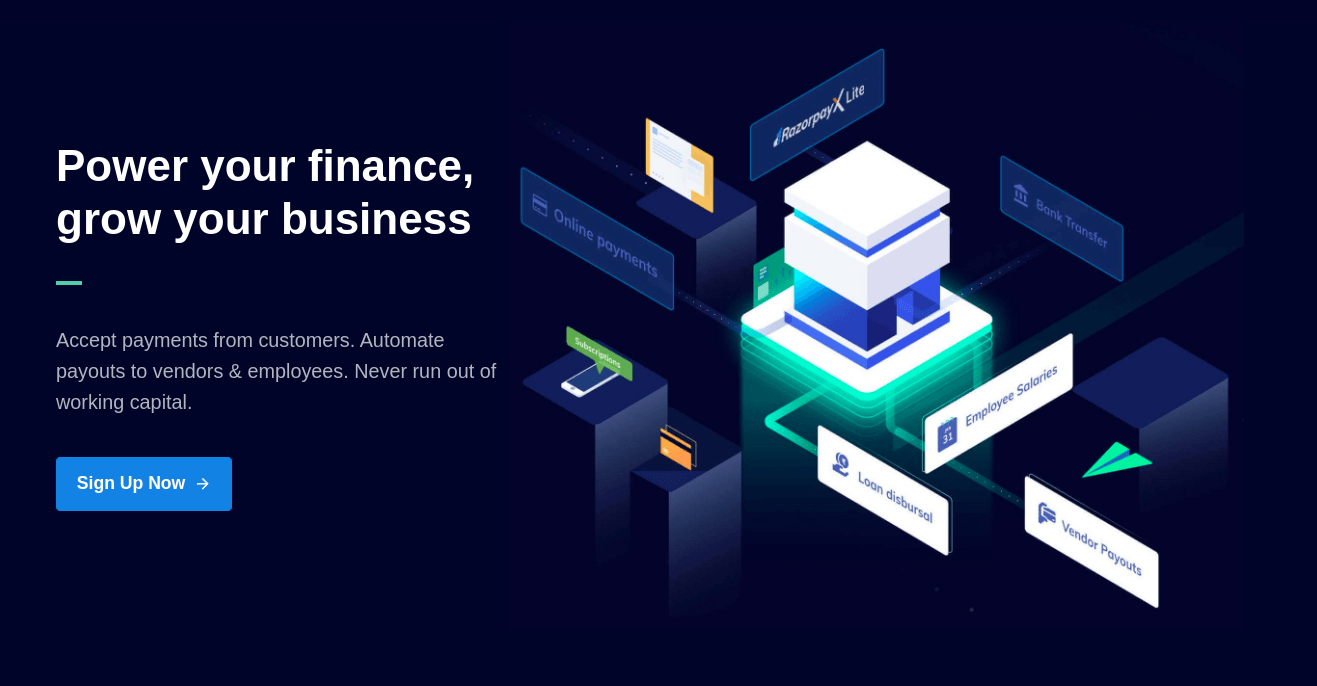

5. Best for India-Based Stores

KeepShoppers Score: 9.5

Key Features

- Complete payment solution

- Online banking

- Payroll automation

Razorpay is a financial platform that helps businesses accept and process payments from customers, manage their banking needs, and automate payroll tasks. It simplifies financial operations, making it easier for businesses to focus on growth and customer satisfaction.

Why We Liked It

As the only payment solution in India that allows businesses to accept, process and disburse payments with its product suite, Razorpay stands out as an ideal buy now pay later platform for India-based stores. With its extensive support for multiple payment methods (including an instant settlement feature) and a strong emphasis on a seamless checkout experience, Razorpay lets you offer flexible payment options to your customers.

Pros

- Diverse payment options

- Instant settlements

- User-friendly checkout

- Comprehensive reporting

- Wide integration support

- API-driven automation

Cons

- Customer service sometimes lacking

- Transaction fees can be high

6. Best for Credit Card Payments

KeepShoppers Score: 9.5

Key Features

- Frictionless payments

- White-label installments

- No credit check

Splitit enables shoppers to split their purchase payments into smaller, interest-free installments using their existing credit cards, without the need for new registrations or credit checks. This helps shoppers budget more effectively while providing merchants with a seamless way to offer installment payment options and increase sales.

Why We Liked It

With Splitit, customers can conveniently use their existing credit cards to make interest-free, manageable installment payments, making it an attractive choice if you want to increase sales and offer a more customer-centric approach to payments.

Pros

- User-friendly

- No interest

- Merchant control

- No impact on credit rating

Cons

- Shoppers must have a credit card

- Customer service doesn't always respond swiftly

7. Best for a Younger Customer Base

KeepShoppers Score: 9.4

Key Features

- Payment within 48 hours

- No credit check for customers

- Purchases split into four payments

Afterpay is a popular BNPL service that allows customers to split purchases into four interest-free payments. It integrates well with Shopify, making it easy for sellers to offer this payment option during checkout. Merchants get paid for the sold items upfront, minus Afterpay's fees.

Why We Liked It

As a BNPL service, Afterpay is a great option for young shoppers. With flexible payment schedules and interest-free payments, it is the ideal choice for Gen Zers looking for affordable ways to treat themselves. What's more, the platform doesn't require a credit check, which is ideal for younger individuals without a credit history.

Pros

- 0% APR

- Easy integration

- Quick approval

- Secure payments

Cons

- No monthly financing plans

» Want to add Afterpay without isuues? Follow this step-by-step Afterpay integration guide

8. Best for Small Purchases

KeepShoppers Score: 9.4

Key Features

- Various financing options

- PayPal purchase protection

- Soft credit check for customers

PayPal is a top pick for many businesses, especially those already utilizing it for payment processing. Simply integrate the BNPL option into your website's checkout to offer customers the option to pay in four installments or monthly. With this solution, you'll also benefit from PayPal's brand recognition and trust.

Why We Liked It

PayPal is ideal for small purchases as it offers PayPal Pay in 4 with financing options for purchases as low as $30. With interest-free installments, a maximum financing amount of $1,500, and no late fees, it provides flexibility and convenience for shoppers.

Pros

- Free for PayPal users

- No late fees or interest

- Lower merchant fees than other BNPL solutions

Cons

- Only for US merchants

- No in-store support

» Not sure which PayPal account to choose? We weigh up business vs personal PayPal accounts

9. Best for Smaller E-Commerce Stores

KeepShoppers Score: 9.3

Key Features

- Soft credit check for customers

- Supports long-term financing for businesses

- Built-in invoicing tool

One of the younger BNPL services on our list, Sezzle lets Shopify merchants offer the option to pay in four easy monthly installments. Customers can also reschedule payments and modify their credit limits, providing them with flexibility in managing their finances.

Why We Liked It

Sezzle is well-suited for small e-commerce stores due to its user-friendly features. Its convenient widgets and comprehensive "Setup Checklist" provide a seamless integration process, making it easy for small merchants to offer BNPL options to their customers. What's more, the company has an excellent support staff that's always ready to help and answer your questions.

Pros

- Easy installation

- Payment rescheduling

- Assumes all risks of fraud or non-payment

- Good customer service

Cons

- Requires 25% down payment upon purchase

» Struggling to integrate Sezzle? Follow these easy steps to add Sezzle to your Shopify store

10. Best for Big Ticket Items

KeepShoppers Score: 9.2

Key Features

- High purchase limit

- Longer terms available

- 0% APR available

- Flexible, omnichannel payments

Affirm offers a simple, no-hidden-fee way to pay for purchases with monthly installments, letting you display a monthly payment price for each item. Because this service offers high purchase limits, it functions like a more traditional loan service compared to other tools designed for smaller purchases. It also offers omnichannel payments across e-commerce and in-person stores and on the phone.

Why We Liked It

The Affirm team negotiates specific terms with each retailer, and the app can be useful for larger purchases as it allows for longer terms and higher total purchase limits—up to $17,500. The innovative Adaptive Checkout feature lets you show the customer multiple flexible and relevant payment options in one view, allowing them to make their decision easily and confidently.

Pros

- Up to 48 months of financing

- No late fees for customers

- Integrates with 47 e-commerce platforms

Cons

- Only available in North America

- Higher interest rates for customers

» Follow this easy guide to seamlessly add Affirm to your Shopify store

11. Best for Risk and Fraud Management

KeepShoppers Score: 9.1

Key Features

- 6 weekly interest-free installments

- Instant, upfront payment from Laybuy

- Integration with various e-commerce and POS platforms

Laybuy is a payment platform that allows customers to make purchases and split the cost into six interest-free weekly instalments. Merchants benefit from immediate payments, reduced fraud risk, and increased customer loyalty.

Why We Liked It

Laybuy stands out for its user-friendly features and benefits. Customers benefit from the convenience of splitting their payments into six interest-free instalments, making their purchases more affordable. Merchants find Laybuy appealing due to its immediate payment settlements, reduced fraud risk, comprehensive dashboard, and seamless integration options, which lead to increased sales and improved financial stability. Additionally, Laybuy assumes credit and fraud risks, offering a secure and worry-free payment solution for merchants, allowing them to focus on growing their business.

Pros

- Comprehensive merchant dashboard

- Reduced fraud risk

- Immediate merchant payment

Cons

- May have issues integrating with Amazon

12. Best for Ease of Use

KeepShoppers Score: 9.1

Key Features

- 4 installments over 6 weeks

- Wide acceptance

- No impact on credit score

Zip is a payment service that lets you split your purchases into four easy payments over six weeks, making it easier to afford what you want. It works almost everywhere that accepts Visa and won't affect your credit score.

Why We Liked It

Zip's user-friendly payment service offers a simple solution for budget-conscious shoppers. With the ability to split payments into manageable installments, wide acceptance, and no impact on your credit score, Zip provides a convenient and flexible way to make purchases while staying in control of your finances.

Pros

- Flexible and easy to use

- Can be used almost anywhere that accepts Visa

- No credit score impact

- Advance notifications to stay on top of payments

Cons

- Long waiting period for refunds

Gain a Competitive Edge With a BNPL Solution

Buy Now Pay Later apps can offer a high level of competitive advantage to e-commerce companies. As things stand, all businesses will likely have to provide BNPL functionality to their customers to remain competitive. To run these services effectively, businesses must pick the right tool for their business.

So, which piece of BNPL software should you pick for your business? As with choosing any apps and tools for your store, the exact choice will depend on your needs. Whether you're a mom-and-pop startup or scaling to the next level, there's an option out there for everyone. Just be sure to identify your unique needs, circumstances, and goals while you're on the hunt for your ideal BNPL solution.

» BNPL is just one way to increase sales. Check out these top apps for boosting your bottom line

KeepShoppers Methodology

When deciding on which BNPL services to include on our list, we looked at these criteria:

- Ease of use for merchants and shoppers

- Loan terms

- Interest rates

- Late fees and other fees

- Credit checks

- Range of payment options

- Customer support for merchants and shoppers

- Customer reviews and ratings

These parameters were aggregated into the KeepShoppers Score you can see in each app description.