Utilizing Shipping Insurance for Your Shopify Store

Published June 13, 2021

AI Summary

Shopify merchants that use Shopify shipping and fulfillment centers located within the US are eligible for shipping insurance up to the value of $5,000 USD. This is a third-party service provided directly through Shopify by Shipsurance. Basically, if the unexpected occurs, a claim can be made directly from a Shopify store’s admin page.

So can you add Shopify insurance to an order?

Simply follow these steps:

How to Add Shipping Insurance on Shopify

Step 1: Purchase a Shipping Label

In order to qualify for Shopify shipping insurance, you must first purchase a Shopify shipping label that includes tracking. To do this:

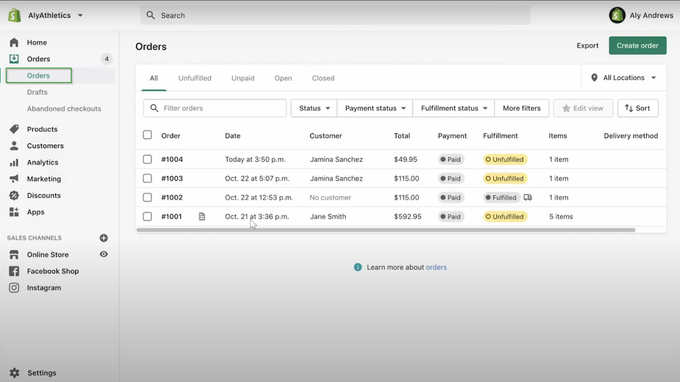

1. Click on the "Orders" option under the main admin menu.

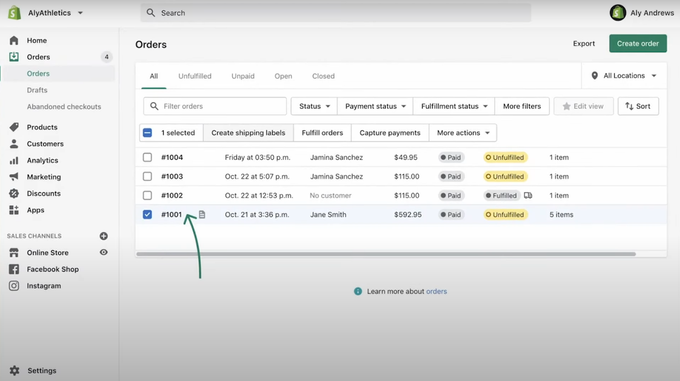

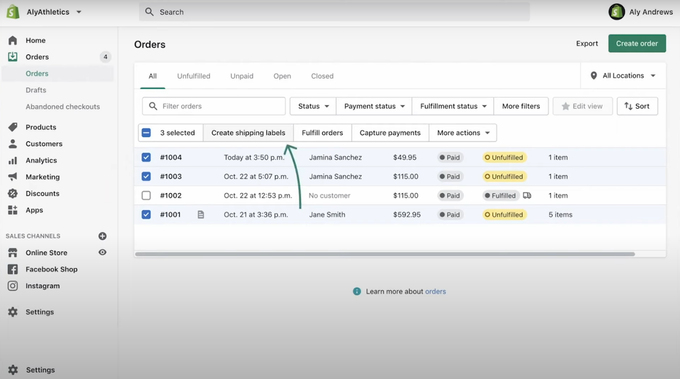

2. Next, click the checkbox of an unfulfilled order you wish to fulfill.

3. Then click the “Create shipping labels” button.

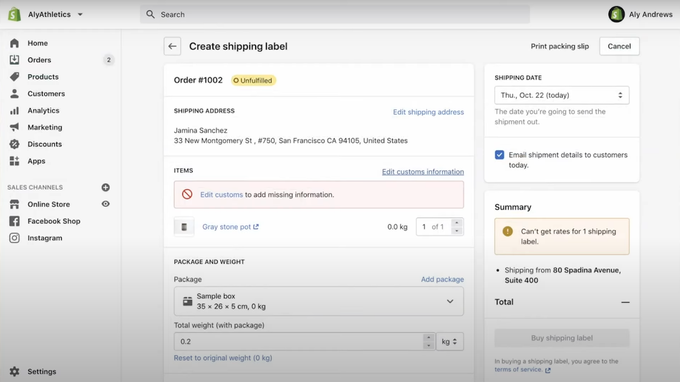

4. Enter any applicable shipping information for that order.

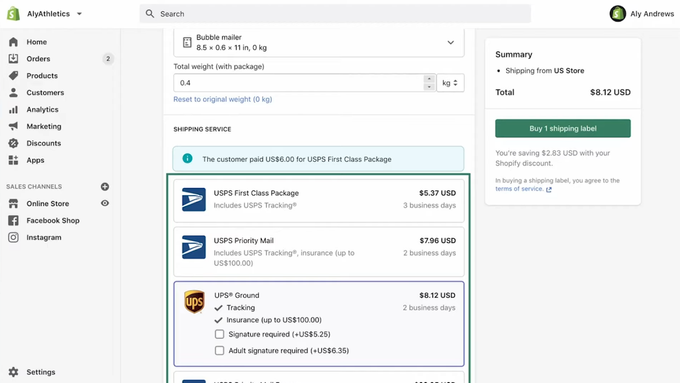

Step 2: Enter an Applicable Insurance Amount

Next, using the Shipping insurance panel, in the “Coverage amount” box, enter the insurance amount you’d like to cover (an amount equal to a product’s cost price or the total order value plus enough to cover shipping costs is best).

Note: Some freight service providers, like UPSS, offer insurance within their shipping costs. This amount of coverage is displayed when ordering a shipping label. It is important to understand that this amount does not combine with any amount of insurance purchased through Shopify for any given order.

For example, if you wish to purchase $200 worth of insurance for an order and UPSS offers $100 worth of insurance coverage, you will still need to order $200 worth of shipping through Shopify. The combining of $100 of UPSS coverage and $100 of Shopify coverage is not permissible, nor is claiming $100 from both parties.

Step 3: Finalize the Order

Once the amount of coverage has been decided upon, simply click the “Buy shipping label” button in the right-hand side panel.

And that’s it, you’re all done.

The Best Third-Party Shopify Insurance Apps

If for whatever reason you decide Shipsurance isn’t the right choice for you, know that there are other third-party options out there for you to choose from instead. Keep in mind, some of the below apps actually offer services and attractive carrier discounts that aren’t available with Shipsurance. Here are the best Shopify insurance app options for you to choose from:

- ShipStation - offers premier discounted rates for USPS, UPS, and DHL.

- Shippo - offers carriers rates from USPS, UPS, DHL, FedEx, and a ton of overseas third-party shipping carriers at highly-discounted rates.

- ShipBob - has warehouses located across the U.S, Canada, and the EU, making it a great option for merchants selling their products both in the States in overseas.

- Easyship - offers merchants access to over 250 different shipping couriers from around the world.

- Shipsaver - as well as offering competitive insurance rates with USPS, Shipsaver also automatically import sales from eBay and Etsy. A great option for merchants that sell their products on platforms other than Shopify.

Every one of these apps is a great option for adding shipping insurance to your customer orders. To integrate their services into your Shopify store, simply click on the corresponding link to sign up and add the app to your Shopify admin.

Do Shopify Stores Need Insurance?

Technically, no. But, if you want peace of mind and protection against worst-case scenarios then it’s highly recommended. And for good reason. A study on e-commerce shipping found that around 1 in every 10 e-commerce packages arrives with some sort of damage.

With that in mind, there really isn’t any reason not to have Shopify insurance.

Why?

Well, mostly because insurance for Shopify customer orders is generally super affordable, only costing a fraction of the total order value. Plus, order damage or loss isn’t uncommon, therefore, Shopify shipping insurance is definitely something you should consider for your online store.

Do Dropshipping Businesses Need Insurance?

Again, not technically. But, if the worst-case scenario were to play out, it’s definitely recommended that a dropshipping business obtains at least a basic level of insurance cover. Apart from shipping insurance, the next two biggest insurance considerations for dropshipping businesses are general liability and cyber risk/privacy liability insurance.

General liability insurance protects online businesses against lawsuits made by third parties over personal or property damages. And cyber risk/privacy liability insurance protects dropshipping against fraud, loss of personal data, and financial loss or theft.

What Kind of Insurance Do I Need for an E-Commerce Business?

In the context of this post, of course, you’d require shipping insurance for your e-commerce business. Although, shipping insurance isn’t the only kind of insurance you can get for your online store.

For instance, if you are working with a fulfillment center or some other major retailer, these types of brick-and-mortar businesses may require your online store to obtain some sort of property insurance, liability insurance, or commercial insurance.

Is It Worthwhile for Shopify Sellers to Get Shipping Insurance?

For sure, it’s definitely worthwhile that Shopify sellers get some sort of shipping insurance. Whether that be through Shopify’s Shipsurance or through a third-party shipping insurance app, obtaining shipping insurance is definitely a small price to pay for peace of mind and loss or theft coverage.

When Should E-Commerce Sellers Buy Shipping Insurance?

I mean, considering the relatively minor costs of shipping insurance (a cost that can easily be integrated into customer shipping), there really is no reason not to cover yourself against shipping issues from the launch of your e-commerce store. $1.25 per $100 USD is a small price to pay even for a startup or fledgling online business.

Is Shipping Insurance for the Buyer or Seller?

Shopify shipping insurance is mostly set up to protect the seller but it also protects the buyer as well.

For instance, let’s say an expensive order gets damaged and the product requires replacing. Well, not only will a good shipping insurance cover the price of the damages but it will allow the seller to replace the buyer’s order at no cost. This works in favor of both parties as the buyer gets a replacement order while the seller isn’t financially inconvenienced at all.

Which Shipping Company Has the Best Insurance?

There really is no right or wrong answer here. The best shipping insurance company that covers damages or loss of Shopify customer orders is one that offers a policy that covers an online store’s unique business requirements.

For instance, for orders made in the United States, either UPS, USPS, FedEx, or Shipsurance are all great options. However, for international shipping or dangerous goods, other companies may be better suited for the job.

How Much Does It Cost to Add Shipping Insurance?

Let’s use Shopify’s in-house insurance Shipsurance for example.

Shipsurance charges $1.25 per $100 USD of required coverage. So let’s say an order has a value of $350, the total cost of insurance would be 3.5 x $1.25 which equates to a total coverage cost of approximately $4.38. Not a bad price when compared to the prospect of covering the total order value if something were to go wrong.

UPS Insurance Costs

For deliveries within the US, UPS charges $0 for insurance up to $100 USD of the total order value and $1.05 for every $100 after that. Although, consider this: UPS has a $2.70 insurance minimum meaning the total order value must be at least $300 or more for UPS shipping insurance.

Maximum Insurance for UPS UPS’s liability insurance is limited to $100 USD on orders and packages with an undisclosed value. If the package value is above $100 USD, customers can declare and insure packages at a higher value, up to $50,000 USD.

Usps Insurance Costs:

For deliveries within the US, USPS charges:

- $1.65 for orders up to $50 USD

- $2.05 for orders between $50.01-$100

- $2.45 for orders between $100.01-$200

- $4.60 for orders between $200.01-$300

- $4.60 + $0.90 with any $100 increase in total order value for orders over $300-5,000

How Does Shipping Insurance Work for USPS? USPS offers its customers standard shipping insurance to protect against damage, loss of goods, or missing contents up to a value of $5,000 USD. Customers can both purchase USPS insurance online or in-person at a local Post Office. Sent packages can be tracked via USPS’s tracking service, allowing customers to check in on their delivery and arrival status.

FedEx Insurance Costs:

For deliveries within the US, FedEx insurance costs:

- $0 for customer orders of a value of up to $100 USD

- $3 for orders between $100.01-$300

- $1 for every $100 of value over $300

Are FedEx Packages Insured? Yes, FedEx packages are insured. Packages that are valued at $100 USD or less cost nothing to insure while orders over this value cost an increasing amount depending on the total order value. FedEx also offers additional insurance to cover potential losses on top of their basic shipping insurance.

Conclusion

Don’t risk the reputation of your business or risk racking up losses from damaged or lost customer orders. Instead, ensure your online store’s Shopify packages are protected by one of these great Shopify insurance options. With the help from their services, you’ll now be able to take advantage of one of these policies and ship your customer orders with peace of mind.